Companies in higher-risk industries find general liability insurance a mandatory expense. They also pay a much higher premium than organizations with lower risks.

Ensuring the purchase of California Contractor General Liability Insurance means to cover all the elements associated with construction projects, including the structure on the job site and the equipment used for the project, the employees, and every other aspect of the construction job.

The basis for the type of policy a company should obtain depends on the scope and size. No two liability policies are built the same. What will suit one company might be entirely inadequate for another business situation. Working with the right agent to develop a custom contractors’ general liability plan will ensure the right option for a company’s specific needs.

Tips On Buying Affordable Liability Contractors’ Insurance

The ideal way for a company to secure the best rates and receive discounts on their contractor insurance is to follow these guidelines:

- Produce quality work every time

- Make it a goal to keep the safety record clear

- Strive for low claims

- Strive for professionalism

- Only work with an agent showing experience and knowledge in the industry

The overall cost will vary based on your work and the size of your organization. For example, a firm that carries out paving duties could pay as much as $20000 in a given year when an individual contractor performing similar duties might only pay a fraction of that.

The reasons are minimal equipment for the job and no requirement for workers’ comp. On the other hand, a major corporation handling significantly large projects would probably pay premiums in the millions. Factors carriers consider:

- The business revenue

- Scope and size of the jobs

- Employees on the projects

- The location you’ll be working. There might be higher premiums for those completing jobs near the coast because flood coverage would be necessary.

What To Look For When Buying An Insurance Plan

When shopping for the ideal insurance policy with the best premiums, there are specific things to consider. It needs to be adequate for your particular company and cover everything you become involved in —some things to pay attention to when buying.

– Coverage

Find out everything covered under the policy. If you find yourself involved with injuries or potentially with lawsuits, these are typically handled if they become a factor on the site. For individuals you employ, that would fall under a different type of plan referenced as workers’ compensation.

There is also no protection if you make professional errors in your work, meaning striving for the highest quality provisions is imperative.

– Price

It’s wise to shop policies before committing to a specific one. Some offer similar protection, but the prices are substantially different. If you choose to buy the first liability plan you come across, you could waste significant money that might have better use within the business elsewhere.

For add-ons that might offer a relatively low premium each month, the deductibles are generally exceedingly high, making them lack cost-effectiveness.

– Deductible

When you find that you need to put in a claim, the deductible is the money you need to pay upfront out of pocket. Once this amount is satisfied, the insurance carrier will pay the remainder. Typically, when an insurer offers low payments, the deductible is exceptionally high. In many cases, taking the chance on that particular plan is too high.

The best option is one that is median for premium and deductible. The low premium/high deductible might make sense if you never used insurance in your career. But it’s essential to reason; there is always a first time for everyone.

Final Thought

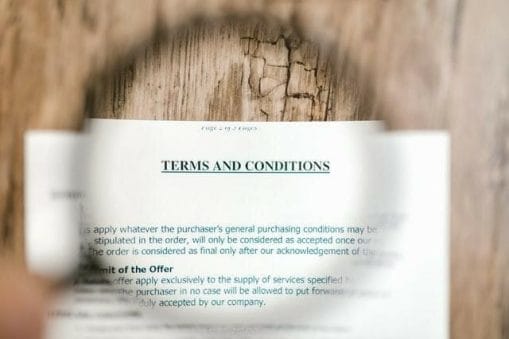

Thoroughly read over the policy before you agree to the terms, including the small print. If you have difficulty understanding what you’re reading, run it by an attorney who can explain it so that you can make sense of it. Once it’s straightforward and clear, you’ll know if it’s right for you and your projects.

General contractors’ liability coverage is mandatory in California. Contractors are grateful to have protection for unforeseen incidents that could otherwise cost them their business if no plan is in place.